You heave probably heard a lot of people talk about Root Insurance and how they are saving a ton of money. They talk about how easy it is to sign up and how awesome the customer service is. And now you decided to test it out your self. Being a Root customer for over 3 years I can honestly say they are my favorite insurance company.

I get the most coverage for the best price.

What Does Root Car Insurance Offer ?

- Great Customer Service

- You Pick Your Deductible

- Root Offers Full Coverage and State Minimum Coverage (Liability Insurance )

- Add Or Remove Cars As You Please

- Get Proof of Insurance / Policy Documents All On The App

- FREE Roadside Assistance Included With Every Policy

- Rental Car Coverage

- Medical Payments

- And Much More

How Does Root Car Insurance Offer Such Low Prices ?

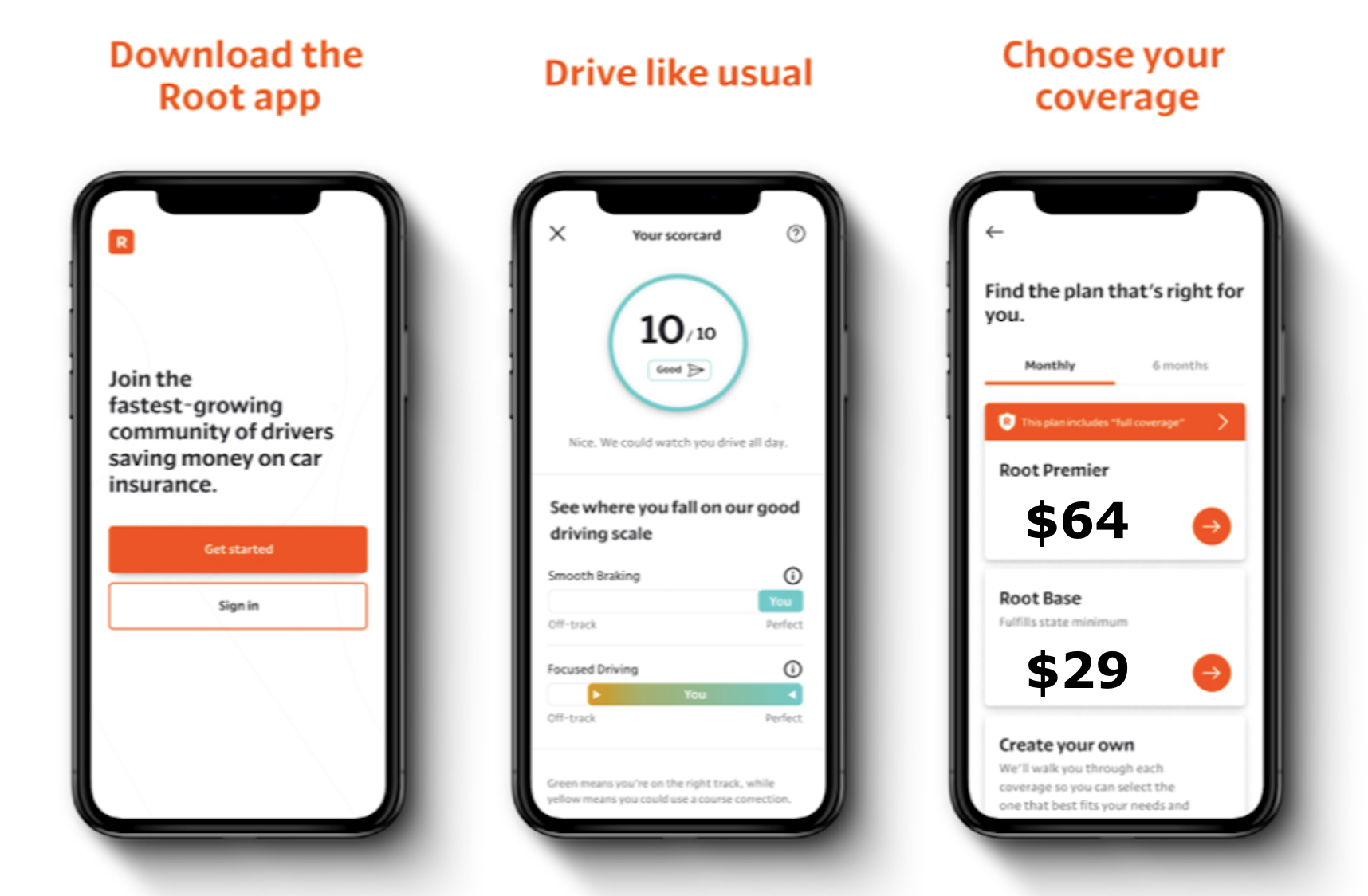

The ability to give you the best price on car insurance is Root Insurance’s strong point. Root, a usage-based firm, monitors your driving during a test-drive period with a mobile app and tailors your auto insurance rates based on your performance. The better you drive the more money you will save. Root rewards good drivers with big discounts. You can save up to 52% by switching to root.

How To Get Started ?

- Download The Root App – Click Here

- Start Your Test Drive

- Choose Your Coverage

- Enjoy and Save Money 🙂

Root Auto Insurance Payments:

Root plans are valid for six months, and drivers may choose to pay their whole vehicle insurance bill all at once or in monthly payments. Payments are made through the app, and policyholders have the option of using a credit card or Apple Pay.

All your insurance documents will be inside the app, Proof of Insurance and Policy Documents. However, the firm will mail you a secondary insurance card as well.

Furthermore, if you want to pay in monthly instalments, you will pick a payment date in the app. In the app, you can also adjust the frequency of payments from monthly to the entire term.

How Do I File a Claim in Root Car insurance?

Following an accident, Root policyholders may use the app to make a claim and get roadside assistance. Make care to provide as much information as possible and, if feasible, add photos. The Root will contact you later to evaluate the claim and decide the next steps.

If you want to speak with a Root claims specialist directly, you can phone during office hours. You may also submit a car insurance claim on the company’s website or by calling the company’s dedicated phone line 24 hours a day, seven days a week. However, you will most likely only be able to speak with a Root claims specialist during business hours.

Root Insurance ( Rental Car Or Free Uber and Lyft Rides )

Root sets itself apart from big national insurers by offering roadside assistance with all of its insurance packages. This is a good perk because most companies charge a fee for roadside assistance. Root separates itself from other insurance by offering rideshare rental reimbursement. Many companies include a rental reimbursement add-on, which covers the cost of a rental automobile while your vehicle is being repaired after a covered accident. In this case, Root enables drivers to use their daily allocation for ridesharing credits rather than a rental car if they want.

You get to choose, rental car or free Lyft or Uber rides 🙂

Home Insurance Coverage With Root

Root also provides home insurance, but only to vehicle insurance customers and only in select states. In exchange for combining vehicle and house insurance, the firm offers homeowners a discount on their home insurance costs.

Advantages of root insurance:

- The Root can keep prices low by refusing to insure dangerous drivers.

- The Root app allows you to accomplish almost anything.

Disadvantages of root insurance:

- Not yet available in every location.

- More likely than other firms to refuse coverage. (Bad Drivers )

Summery

Root Car Insurance is a great company in my opinion. It offer great coverage, benefits and customer service. I hight recommend you give Root a try and see how much money you can save on your car insurance.